Reports in the Zenyo Payroll show the complete reports of the employee’s payroll, employee information, and loan report.

Payroll Reports

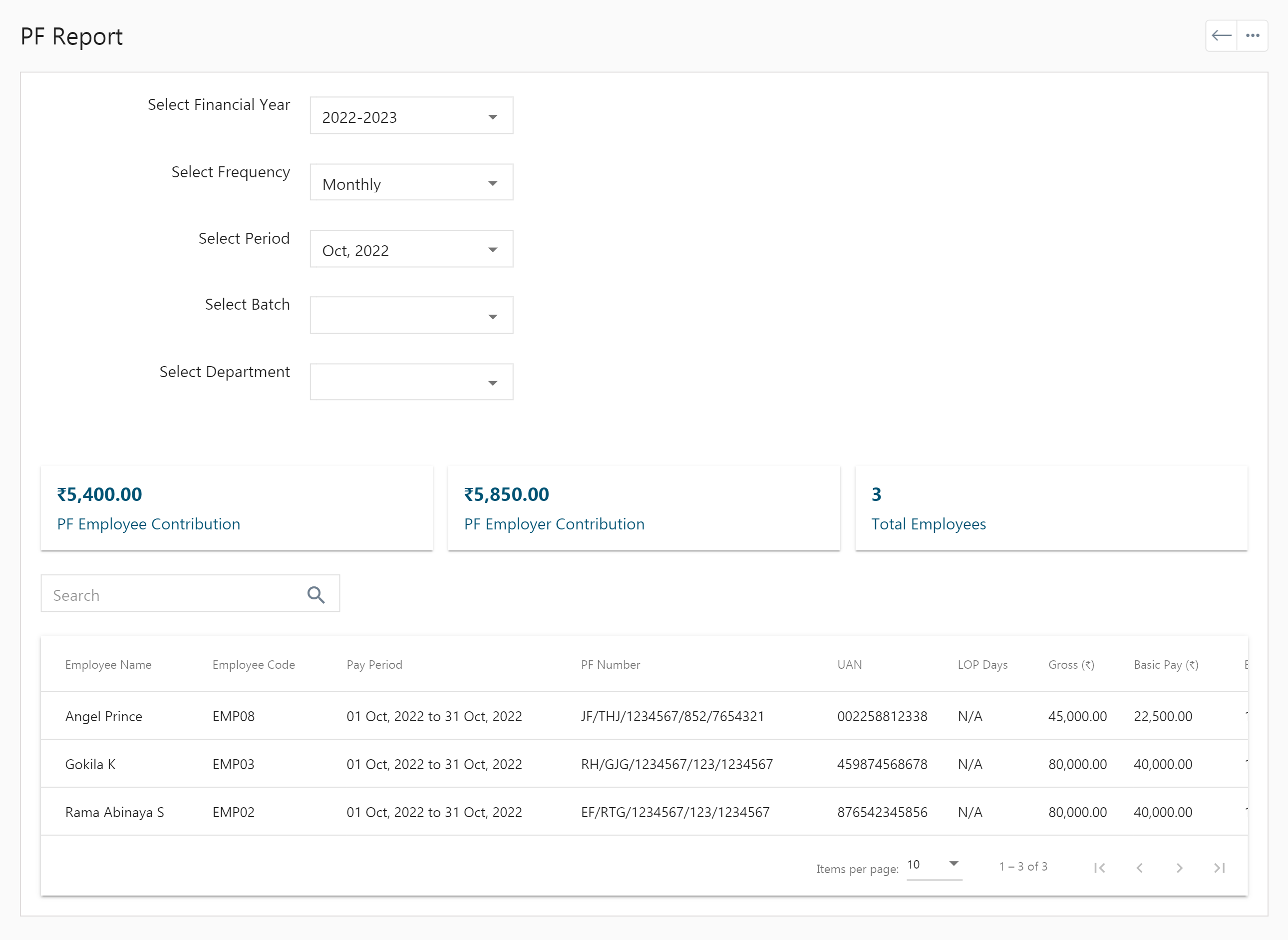

PF (Provident Fund) Report

- Click on the PF report, and select the financial year, frequency, period, batch, and department.

- It displays the Employee contribution, Employer contribution, and the total number of employees who submitted the PF declaration.

- This report also shows a table displaying details like Employee Name, Employee Code, Pay Period, PF Number, UAN, LOP Days, Gross (₹), and Basic Pay (₹).

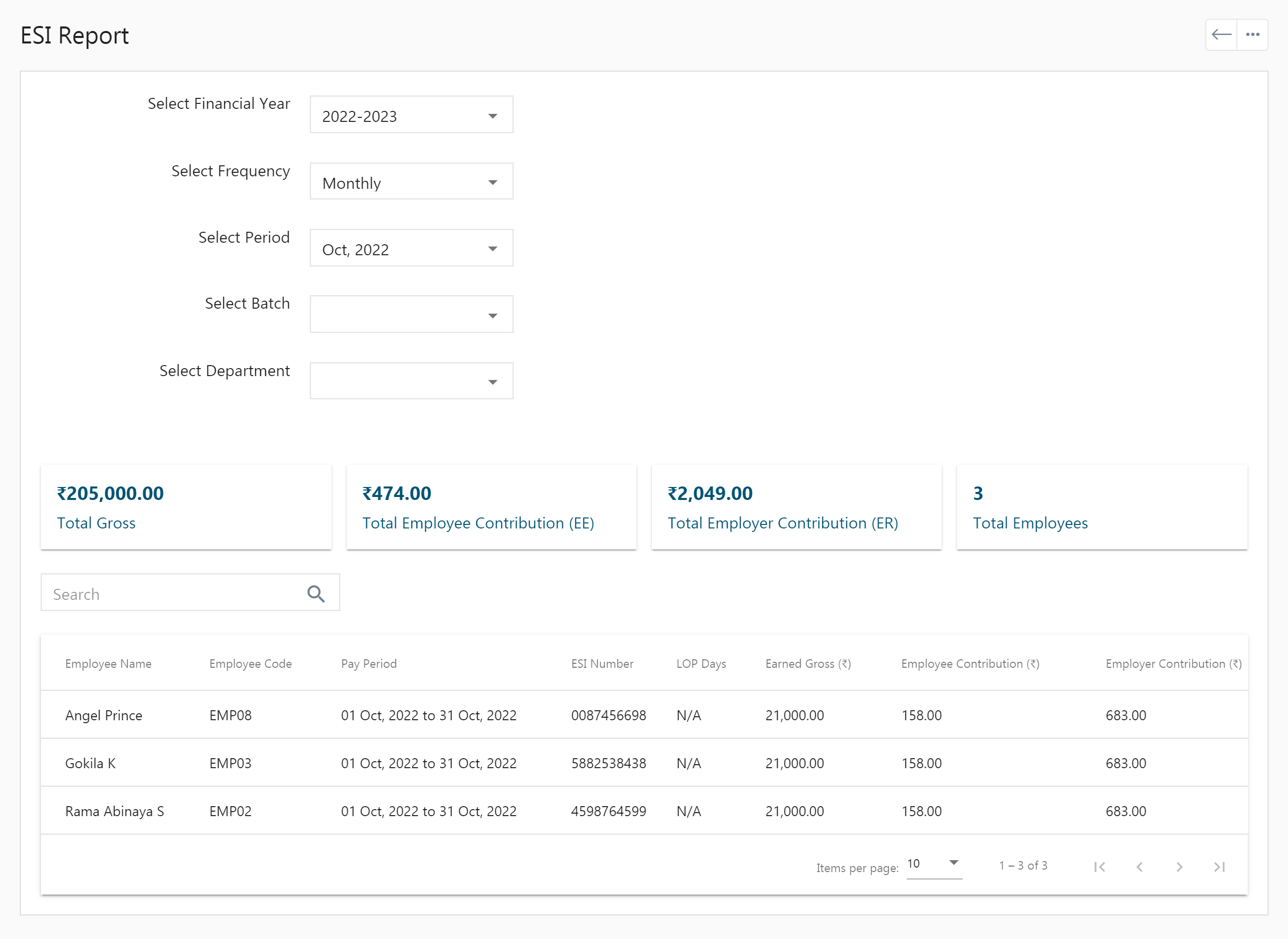

ESI (Employees’ State Insurance) Report

- Click on the ESI report, and select the financial year, frequency, period, batch, and department.

- It displays the Total gross, Employer contribution, Employee contribution, and the total number of employees who submitted the ESI declaration.

- Employee Name, Employee Code, Pay Period, ESI Number, LOP Days, Earned Gross (₹) and Employee Contribution (₹) get displayed in a table.

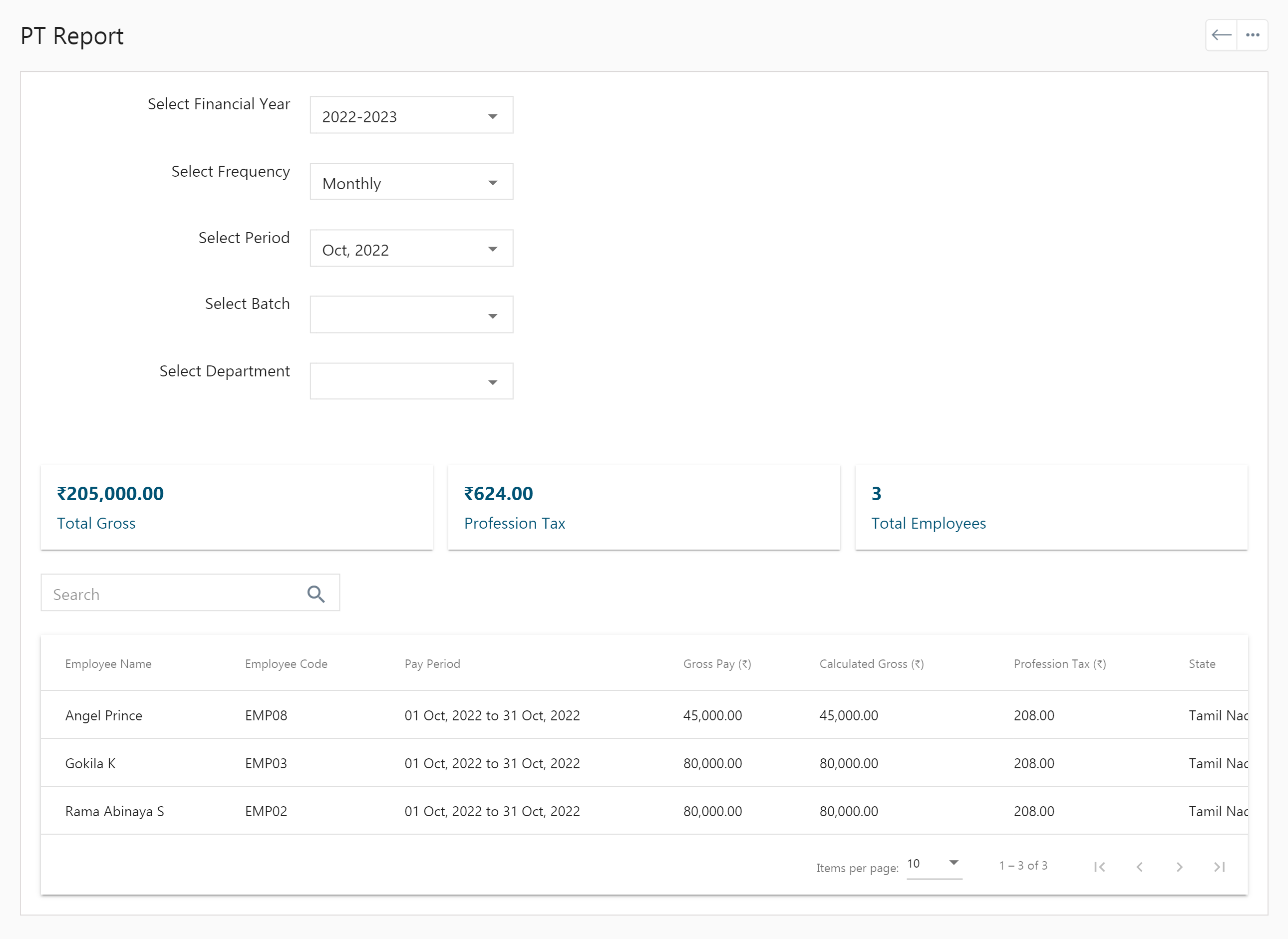

PT (Professional Tax) Report

- Click on the PT report, and select the financial year, frequency, period, batch, and department.

- It displays the total gross, professional tax, and the total number of employees who submitted the Professional Tax details.

- Employee Name, Employee Code, Pay Period, Gross Pay (₹), Calculated Gross (₹), Profession Tax (₹), and State are displayed in a tabular format.

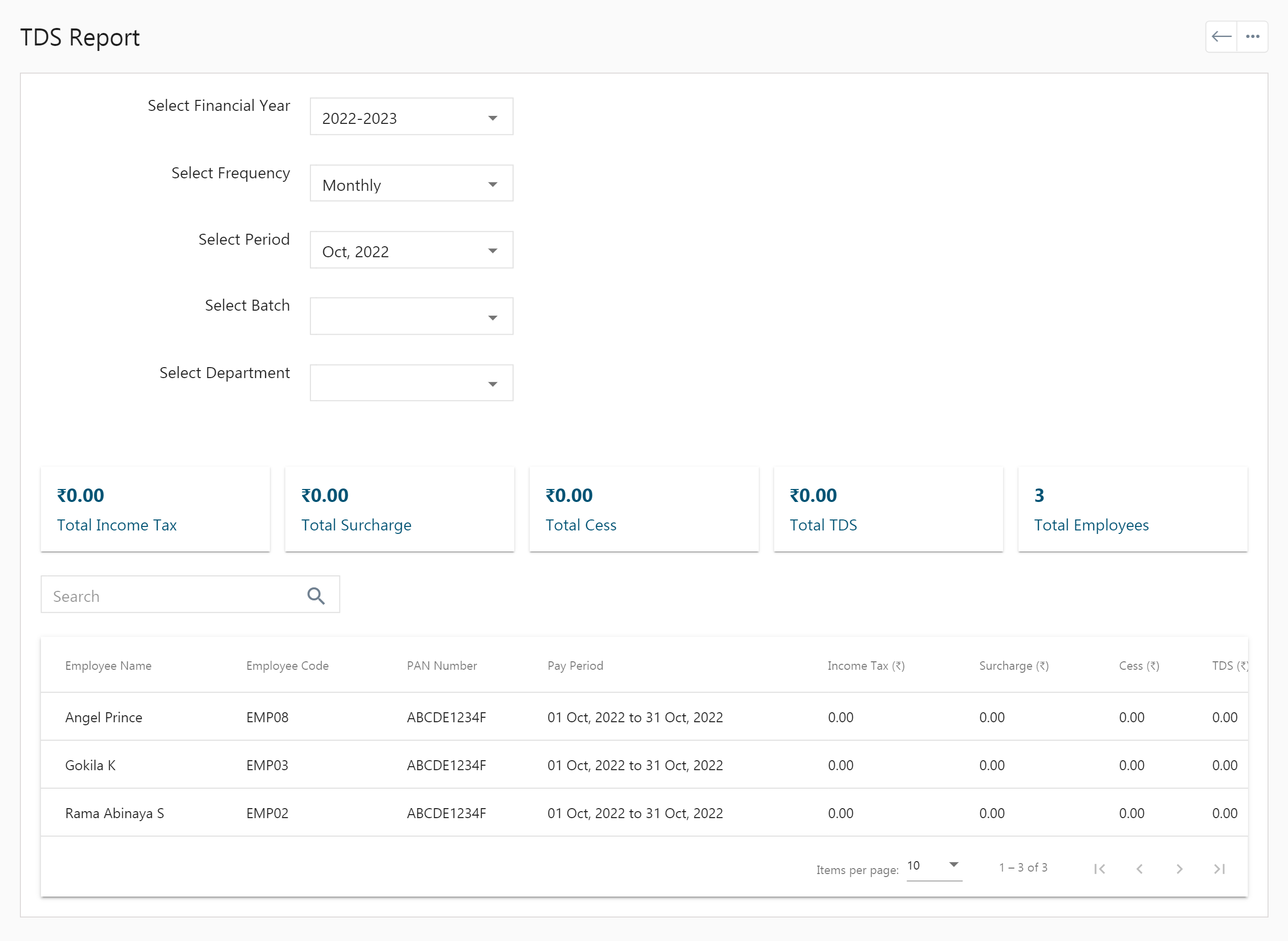

TDS Report

- Click on the TDS report, and select the financial year, frequency, period, batch, and department.

- It displays the total income tax, total surcharge, total Cess, total TDS, and total employees of TDS submissions.

- Employee Name, Employee Code, PAN number, Pay Period, Income Tax (₹), Surcharge (₹), Cess (₹), and TDS (₹) get displayed in a table.

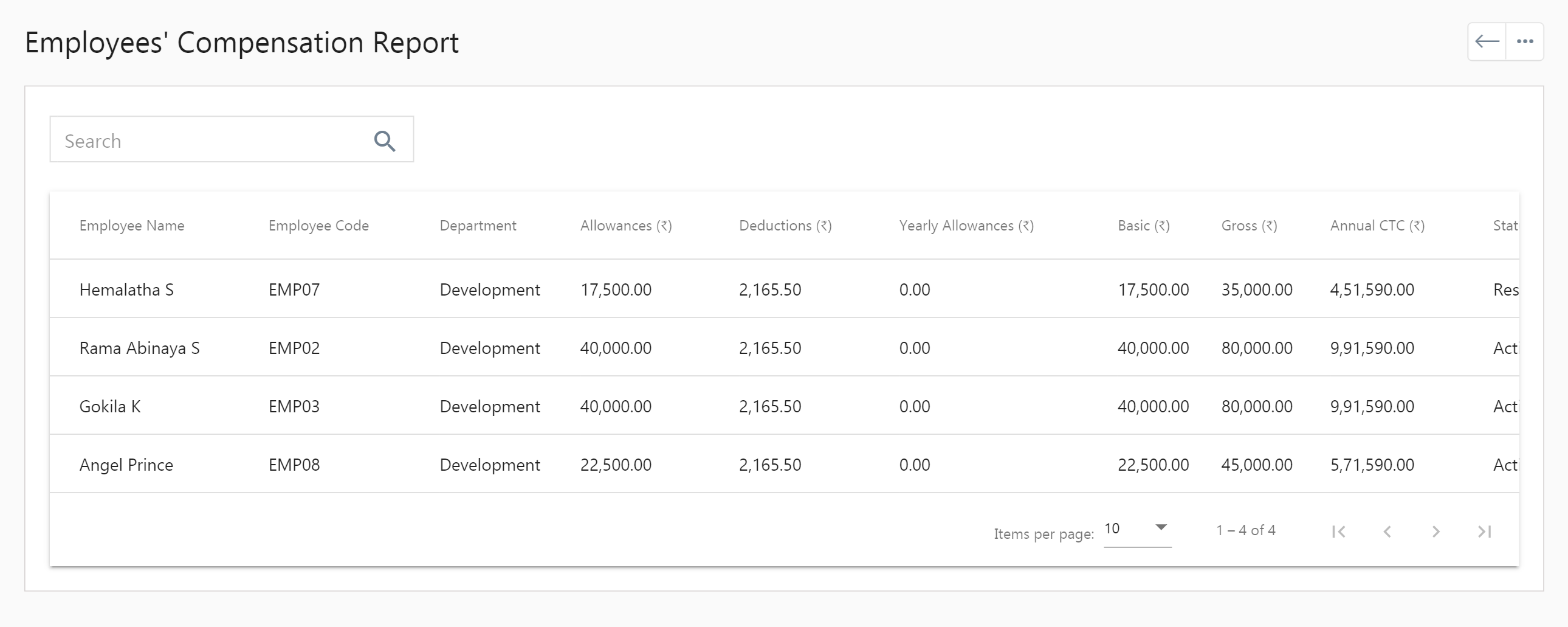

Employees’ Compensation report

- Click on the Employees’ Compensation report where you can view the Employee Name, Employee Code, Department, Allowances (₹), Deductions (₹), Yearly Allowances (₹), Basic (₹), Gross (₹), Annual CTC (₹) and Status.

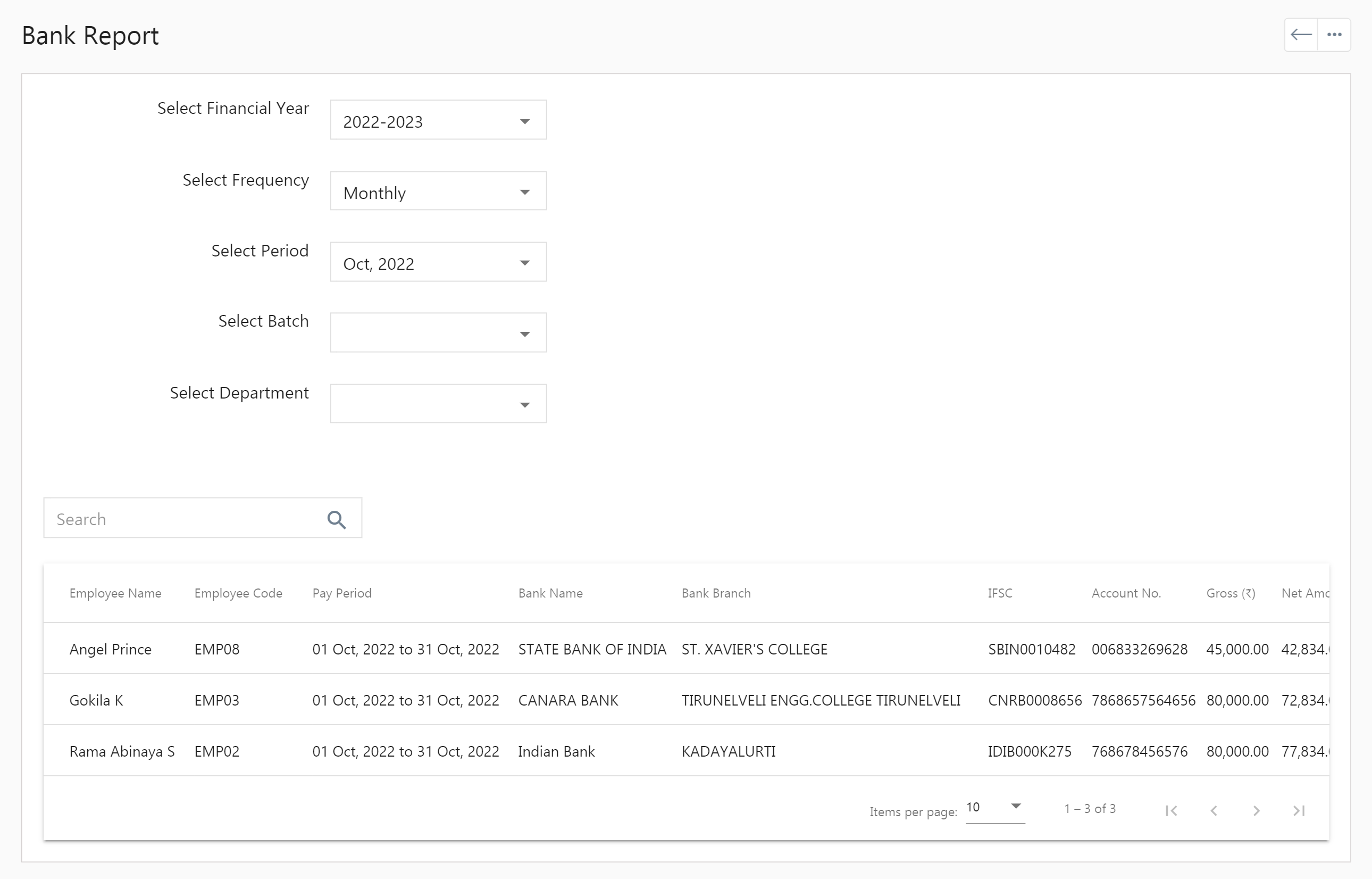

Bank Report

- Click on the Bank report, and select the financial year, frequency, period, batch, and department.

- It displays the Employee Name, Employee Code, Pay Period, Bank Name, Bank Branch, IFSC, Account No, Gross Pay (₹), and Net Amount (₹).

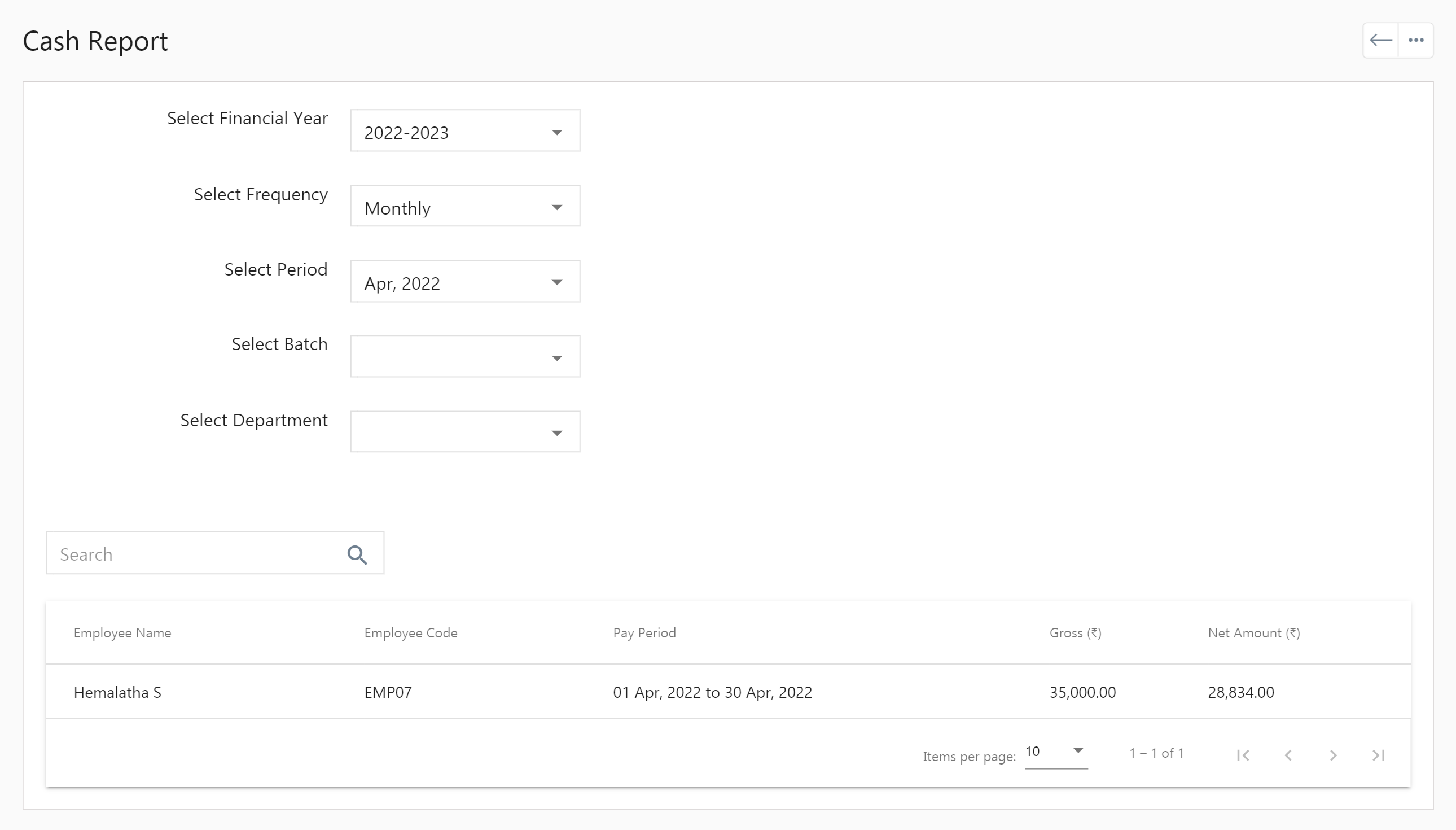

Cash Report

- Click on the cash report, and select the financial year, frequency, period, batch, and department.

- It displays the Employee Name, Employee Code, Pay Period, Gross Pay (₹), and Net Amount (₹).

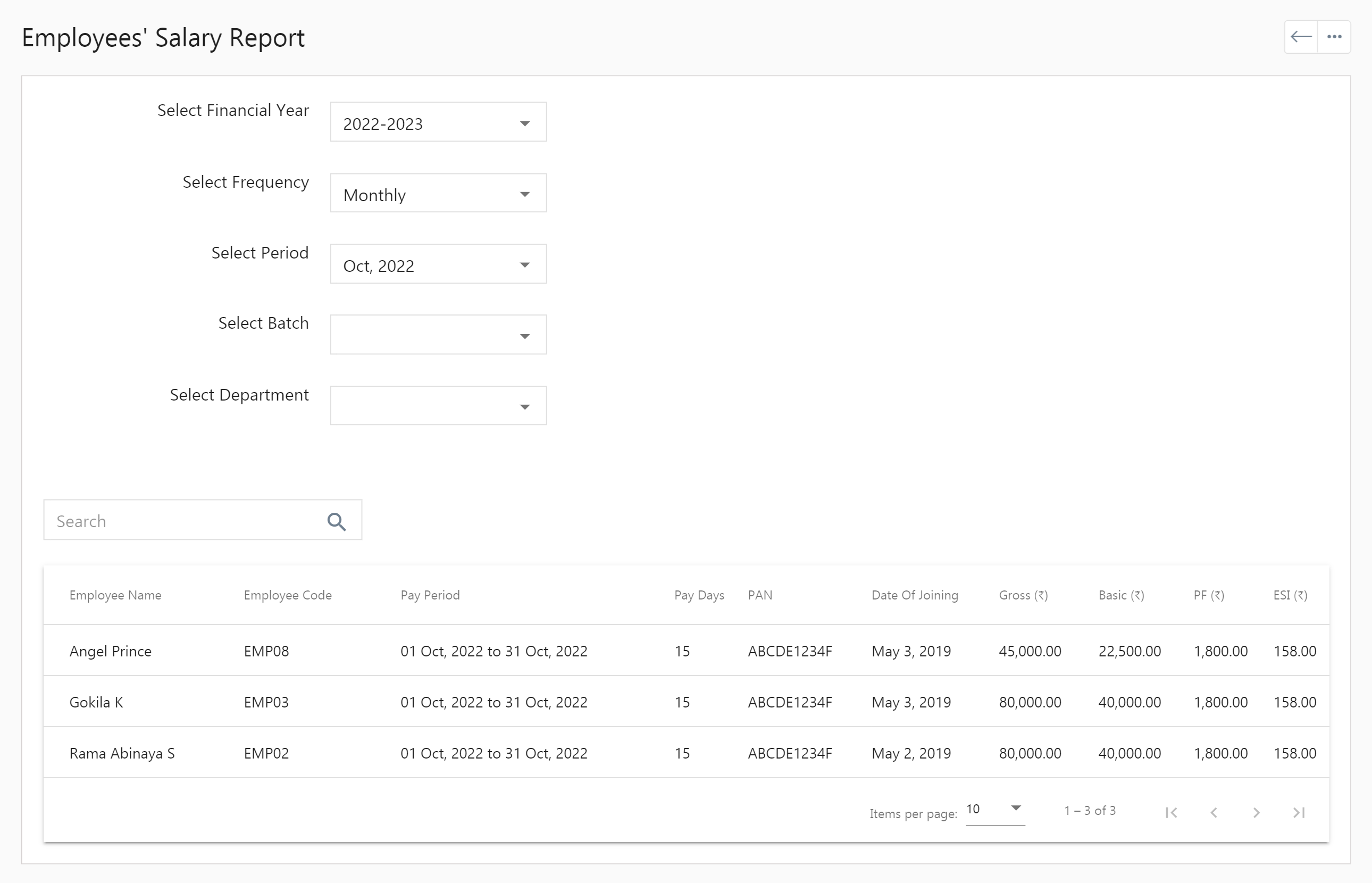

Employees’ Salary Report

- Click on the Employee’s salary report, and select the financial year, frequency, period, batch, and department.

- It displays the Employee Name, Employee Code, Pay Period, Pay Days, PAN, Date of Joining, Gross (₹), Basic (₹), PF (₹), ESI (₹), Profession Tax (₹), Advances/Loans (₹), Income Tax (₹), Surcharge (₹), Cess (₹), and Net Amount (₹).

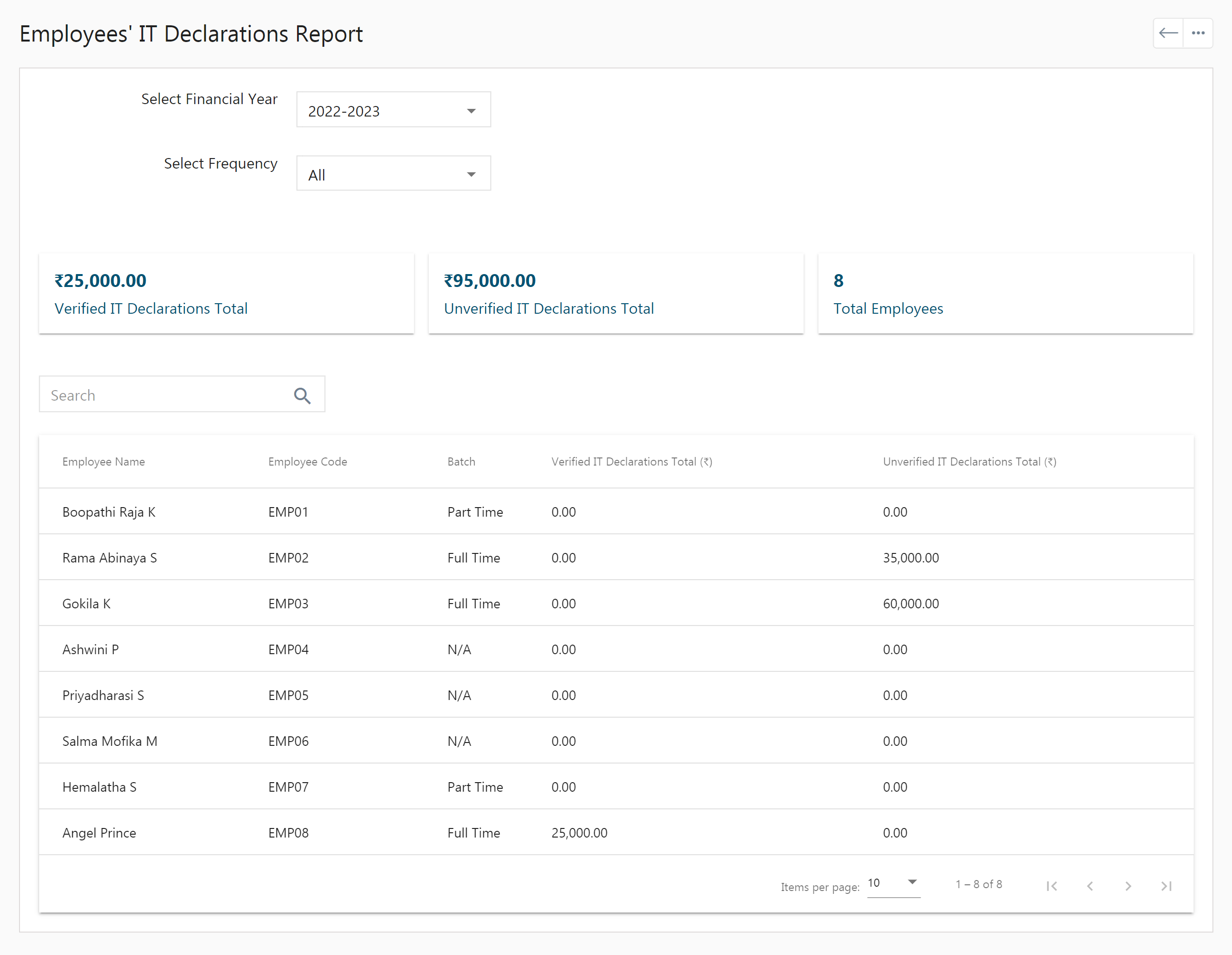

Employees’ IT Declarations Report

- Click on the Employee IT declaration report, and select the financial year and frequency.

- It displays the total verified IT declarations, unverified IT declarations, and total employees.

- The tabular view shows the Employee Name, Employee Code, Batch, Verified IT Declarations Total (₹), and Unverified IT Declarations Total (₹).

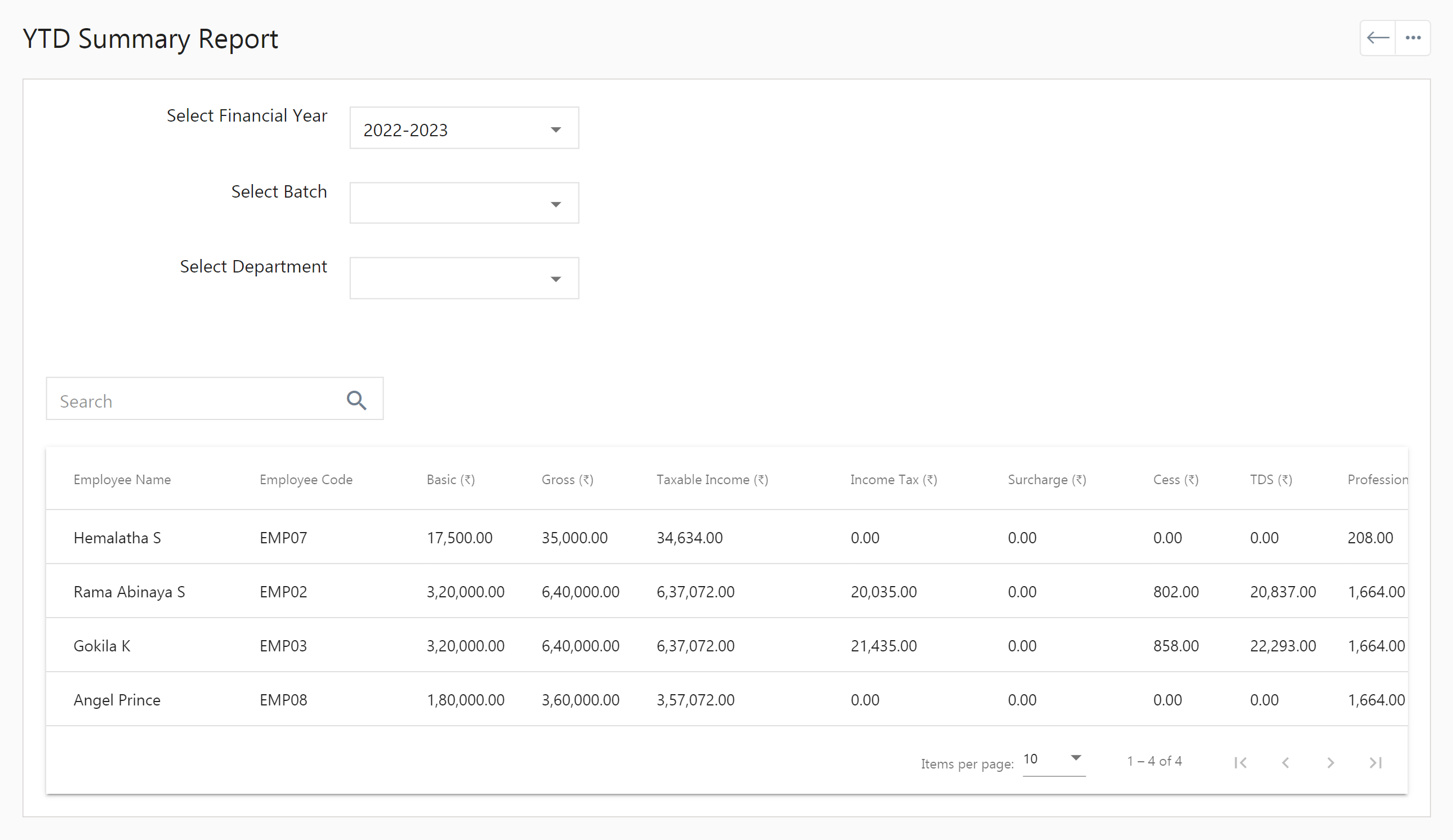

YTD Summary Report

- Click on the YTD (Year to Date) report, and select the financial year, batch and Department.

- It displays the Employee Name, Employee Code, Basic (₹), Gross (₹), Taxable Income (₹), Income Tax (₹), Surcharge (₹), Cess (₹), TDS (₹), Profession Tax (₹), and Net Amount (₹).

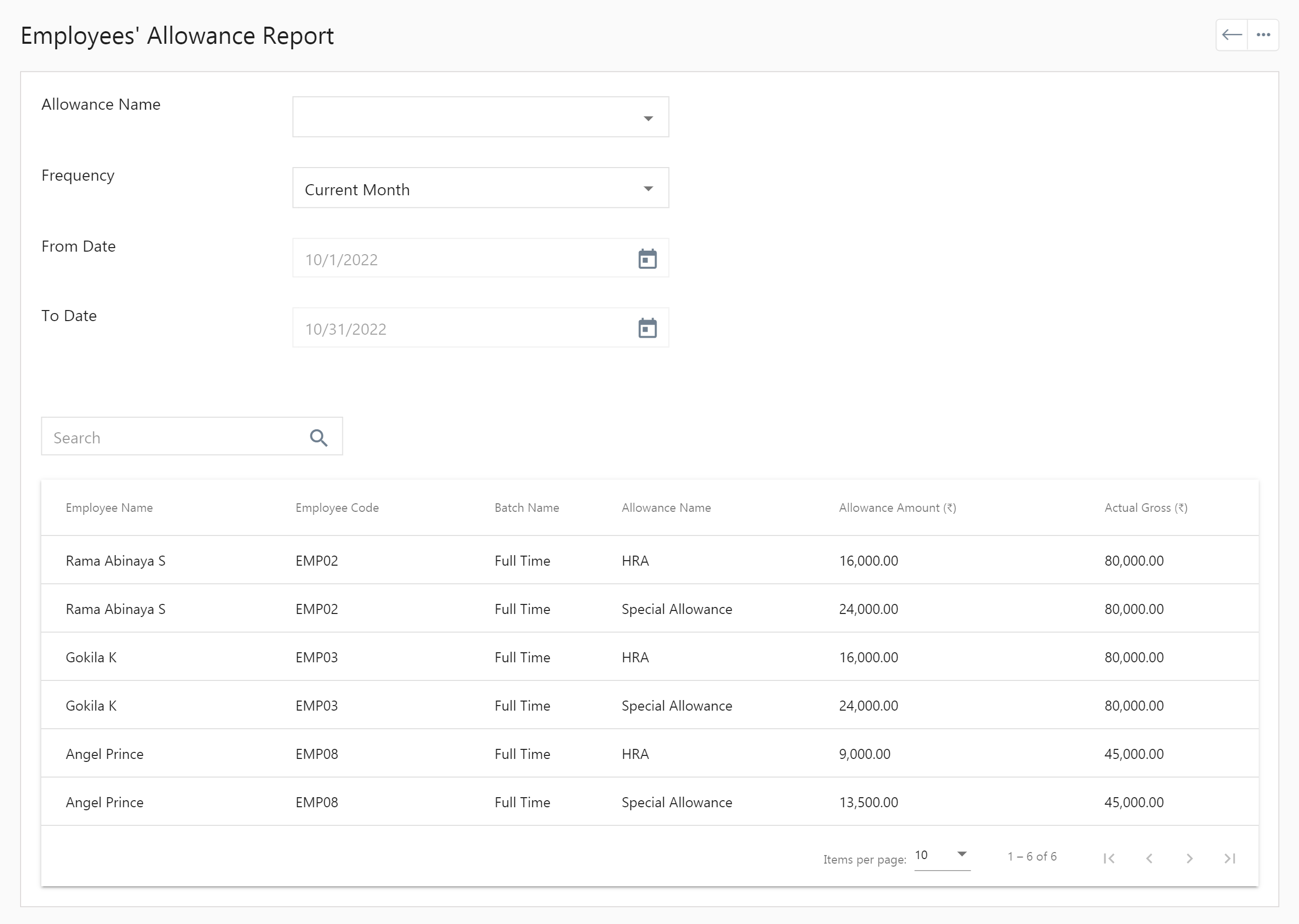

Employees’ Allowance Report

- Click on Employee’s Allowance Report, choose the allowance name frequency, from and to date of allowance. The report for the chosen allowance is displayed.

- It displays the employee name, employee code, batch name, allowance name, allowance amount, and actual gross (₹).

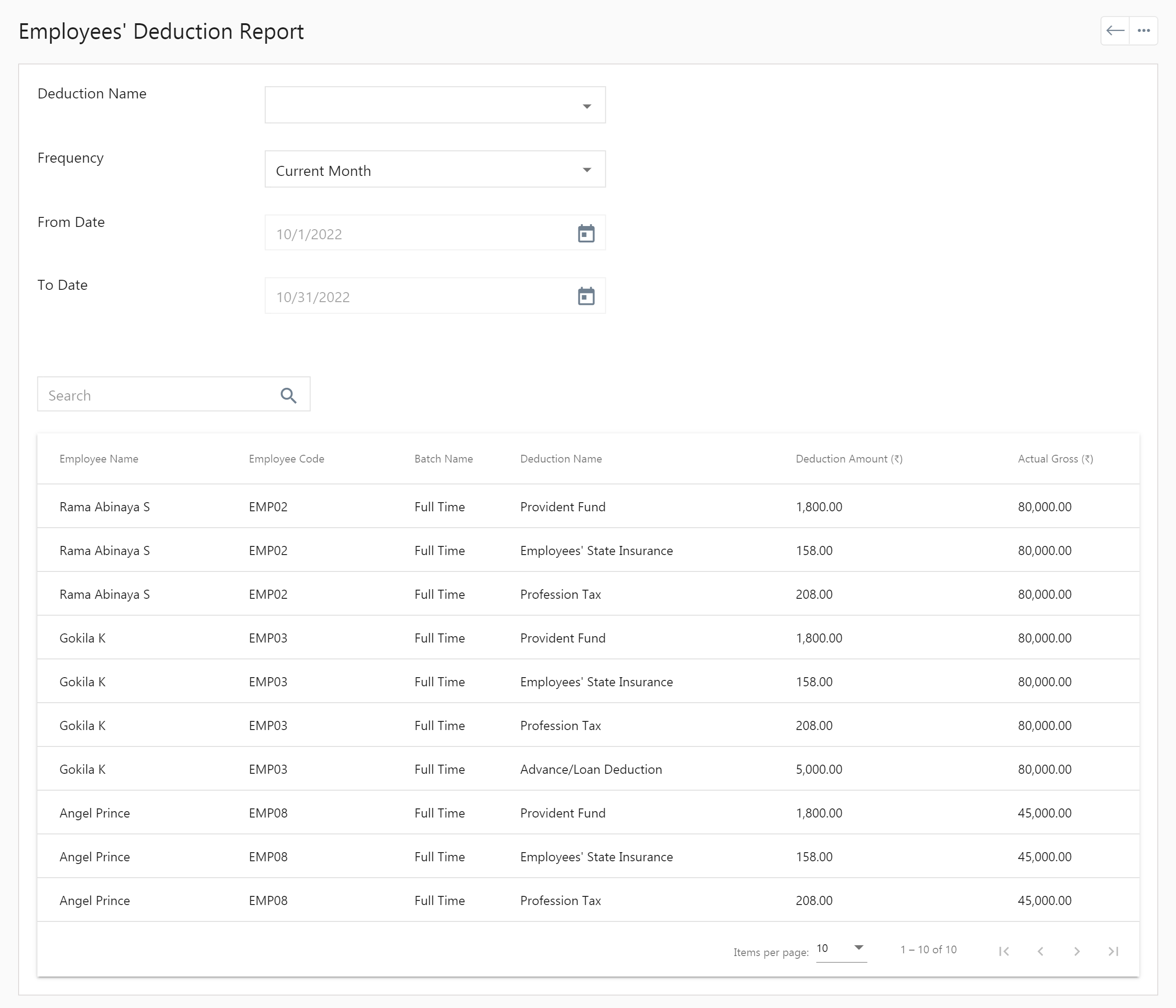

Employees’ Deductions Report

- Click on Employee’s Deduction Report, choose the deduction name frequency, from and to date of Deduction. The report for the chosen deduction is displayed.

- It displays the employee name, employee code, batch name, deduction name, deduction amount, and actual gross (₹).

Employees Report

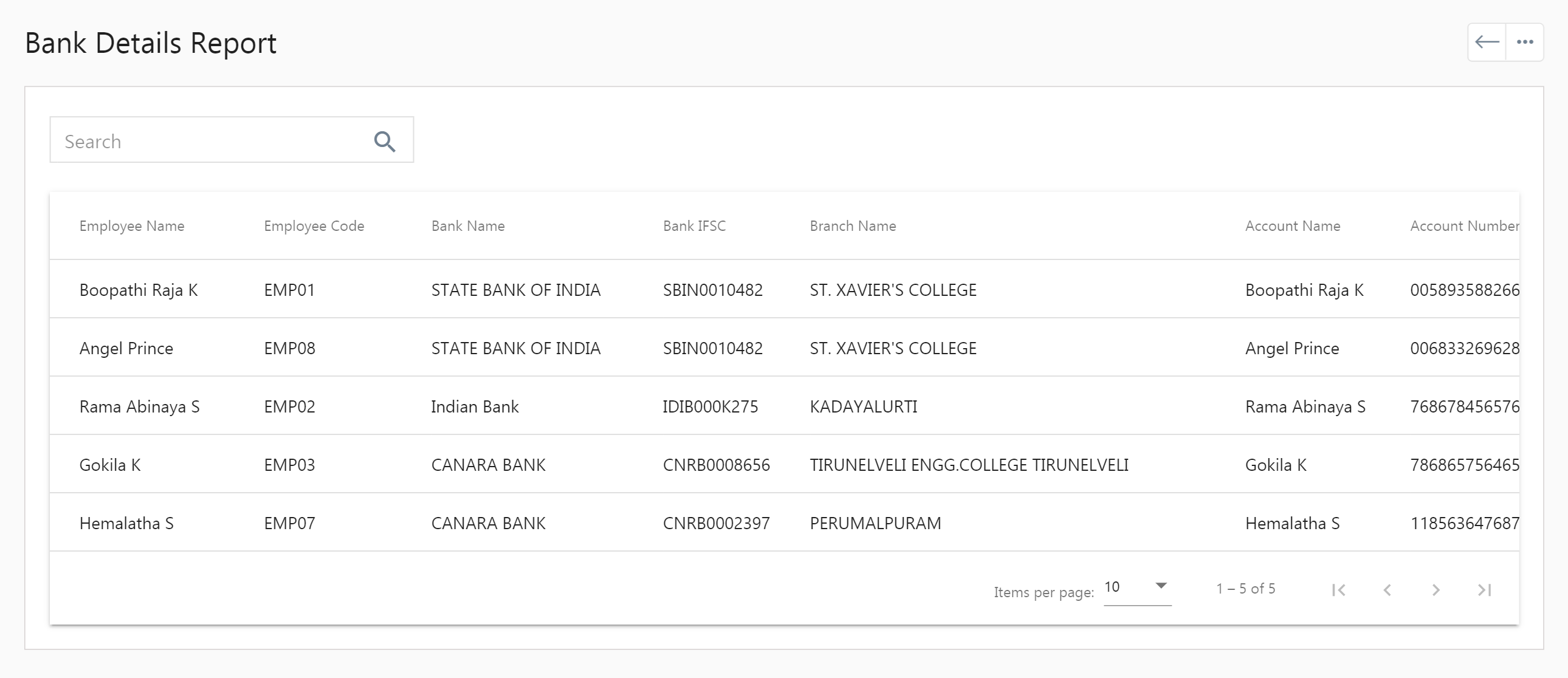

Bank Details Report

- The bank details report shows the employee bank information such as employee name, employee code, bank name, bank IFSC, branch name, account name, and account number.

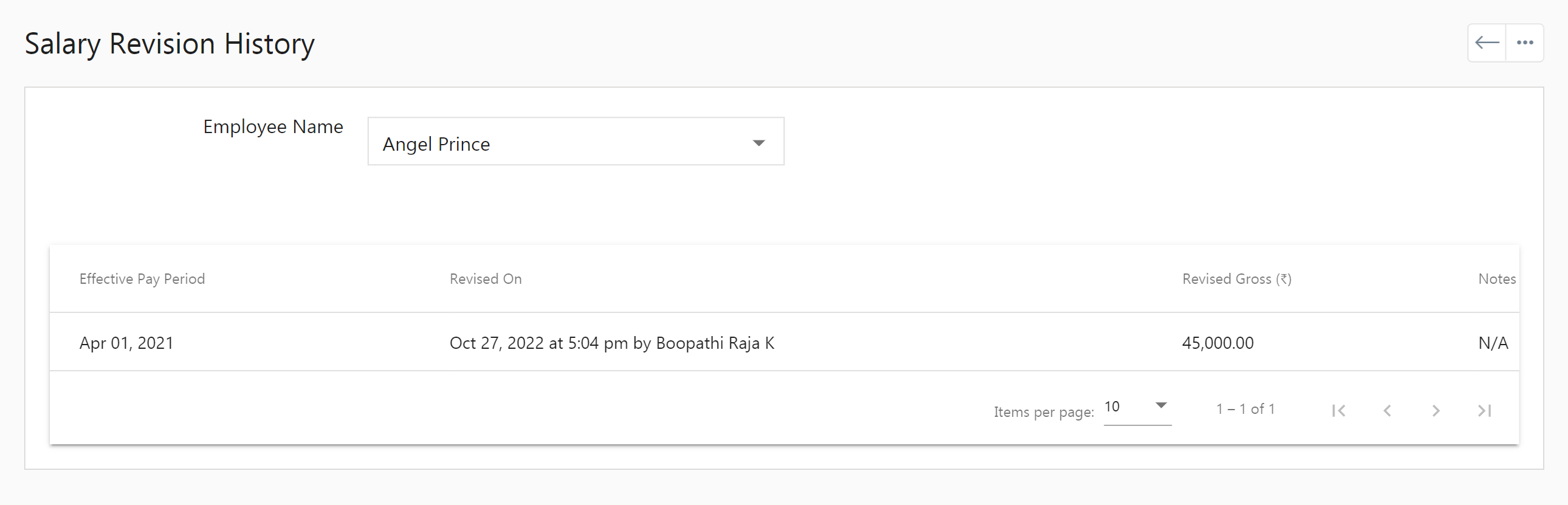

Salary Revision History

- In the salary revision history, choose the employee name to view the effective pay period, revised on (date and employer name), revised gross (₹), and notes.

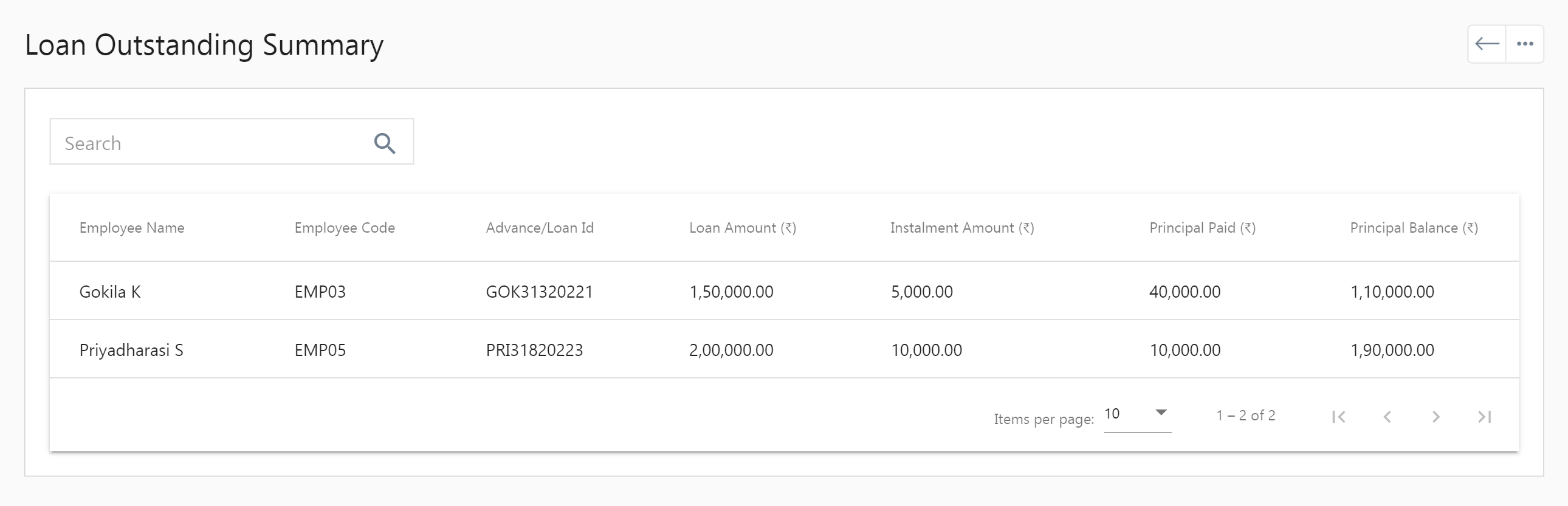

Loan Reports

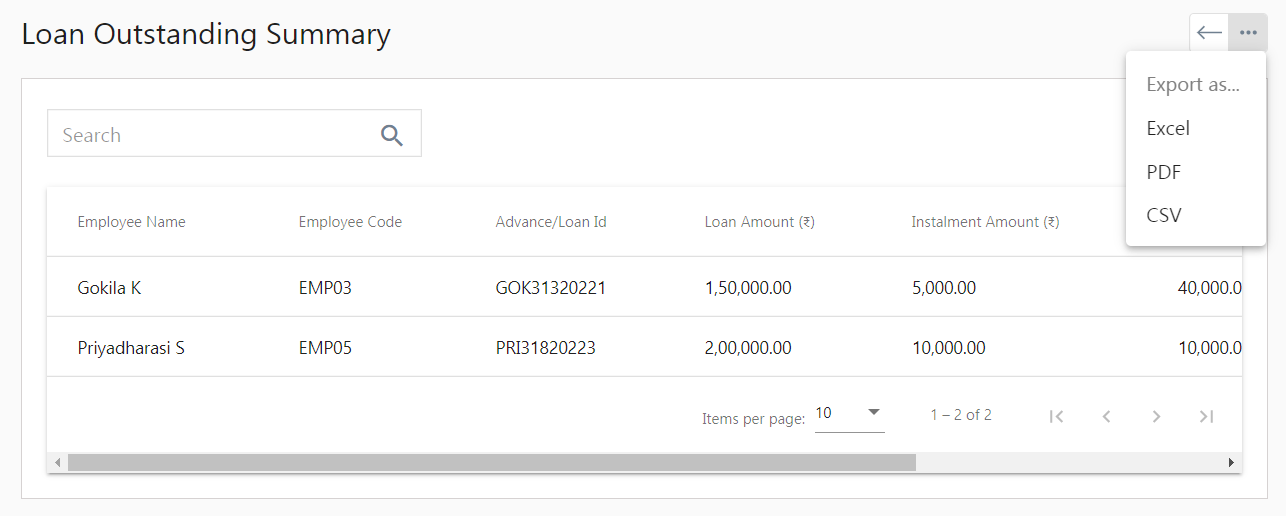

Loan Outstanding Summary

- In the loan outstanding summary, the super admin can view the employee name, employee code, advance/loan ID, loan amount (₹), installment amount (₹), principal paid (₹), and principal balance (₹).

How to export reports in Zenyo Payroll?

- Click on the respective report.

- Tab the dot icon at the top-right corner.

- You can export the report in Excel, PDF, or CSV file format.